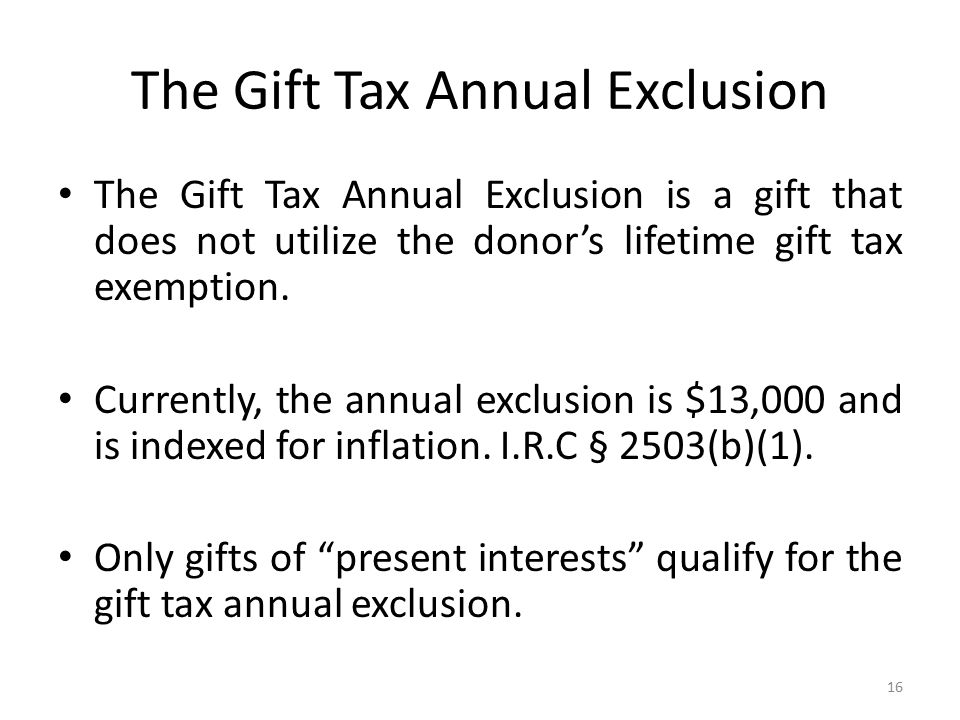

what gifts qualify for the annual exclusion

Funding the SLAT Such gifts are excluded from gift tax only if they are gifts with present interest meaning that the recipient. Minors Trust under Section 2503 c.

New Jersey Gift Tax All You Need To Know Smartasset

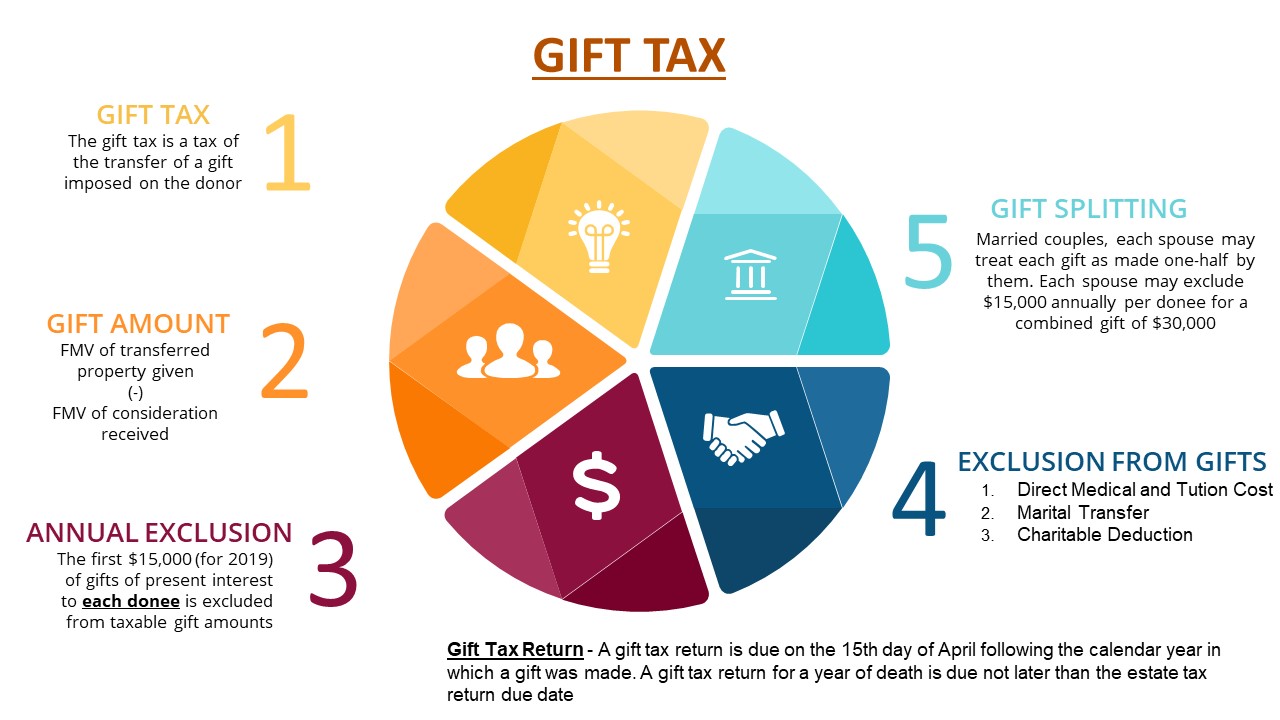

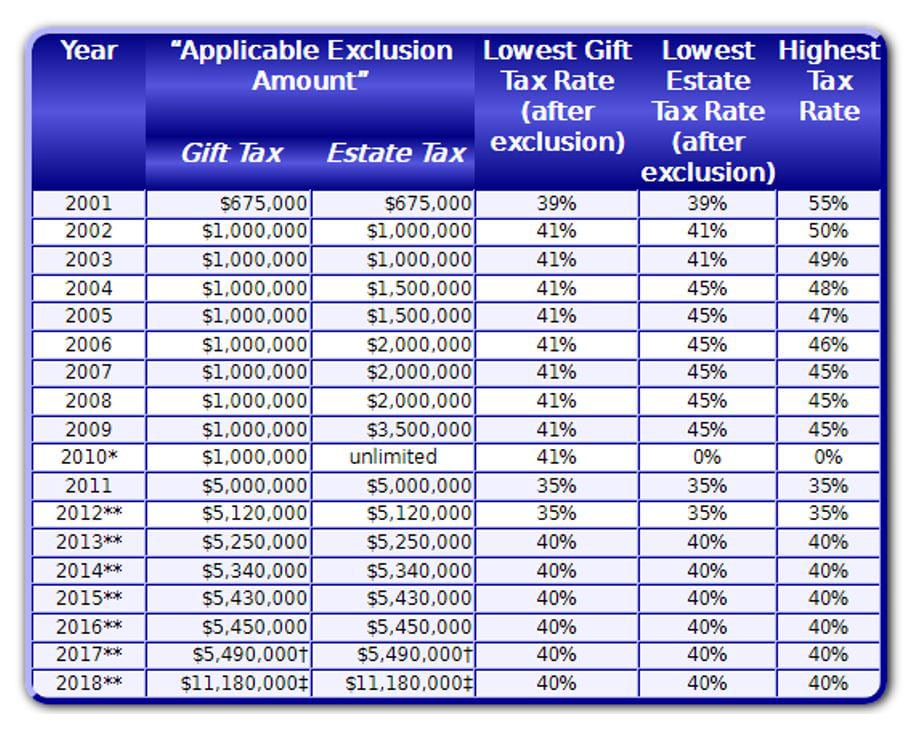

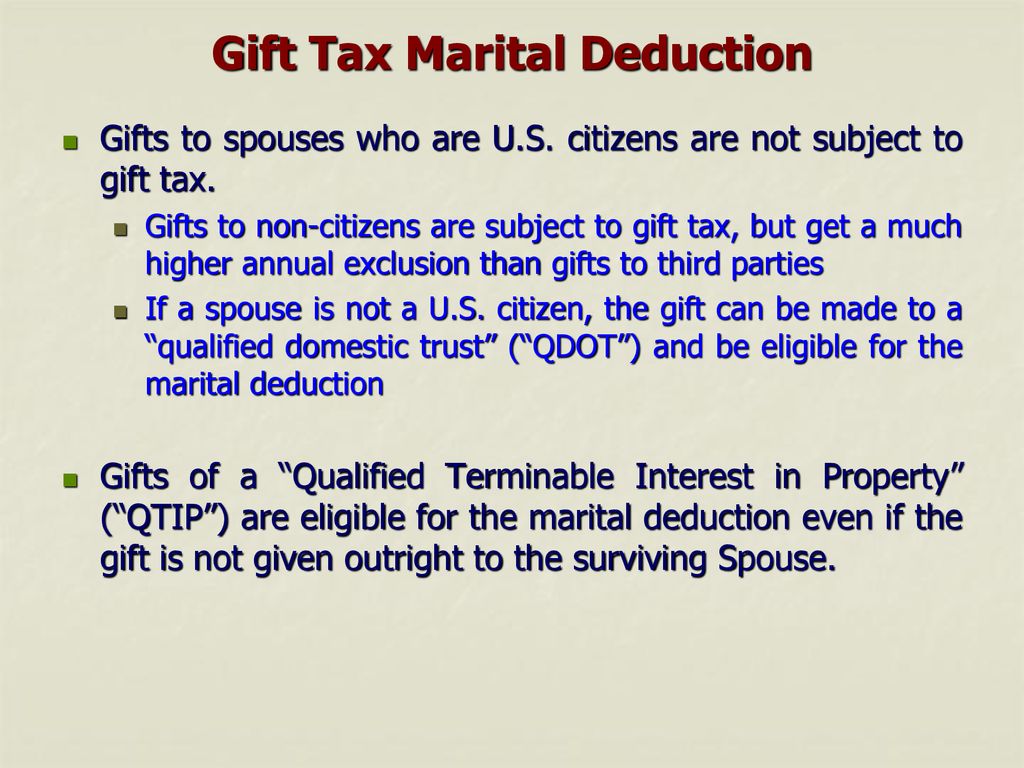

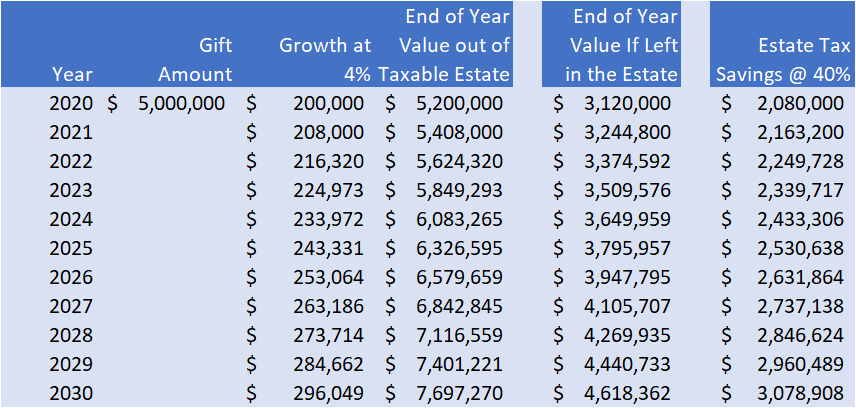

The transfer tax system all lifetime gifts and bequests made at the time of death that exceed certain dollar thresholds are subject to gift and inheritance tax rates of up to 40.

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

. This is currently set as 1206 million per donor in 2022. In 2018 each person has a lifetime gift tax exemption of 11180000 and a lifetime generation-skipping transfer GST tax exemption amount of 11180000. Do gifts to a slat qualify for the annual exclusion.

The basic exclusion amount is a combined lifetime gift and estate tax exemption. Throughout the year you likely give gifts to family and friends for many different reasons. Under the IRC a transfer is not a.

Annual Exclusion Gifts. Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minors Trust under Internal Revenue Code Section 2503c or has certain temporary withdrawal. In addition to these.

Gifts might consist of cash stocks or bonds works of art or even real estate. What assets qualify for annual exclusion gifts. However the annual exclusion is available only for.

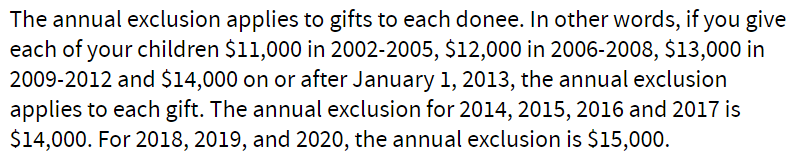

An annual exclusion gift is one that is below a certain dollar amount so that qualifies it to be excluded from federal gift taxes in a given year. While most of these gifts are simple and require no action on your part as it pertains to the IRS more. The recipient must be granted immediate and unrestricted use possession or enjoyment of the.

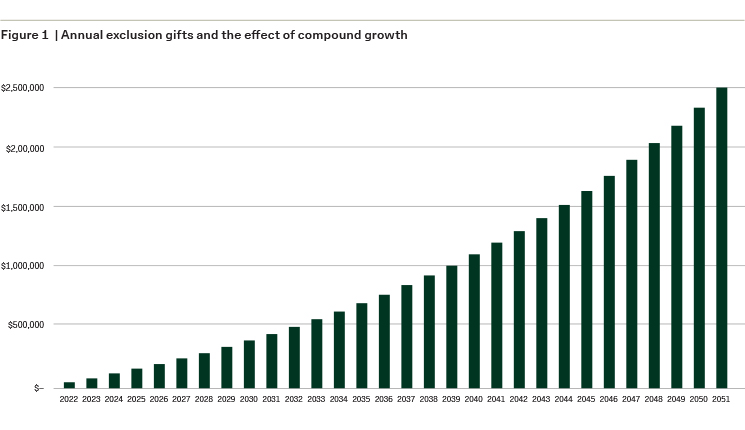

An annual exclusion gift qualifies for the 16000 per person per year exemption from federal gift taxes in 2022. For real estate valued at more than 13000. Itll also limit the donor to 20000 annual exclusion.

2503 an annual exclusion is allowed for taxable gifts the amount of which as adjusted for inflation was 12000 in 2007. Nevertheless certain terms must be included in the trust instrument if gifts to the trust will qualify for the annual exclusion. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient.

Gifts are subject to a federal tax but an exemption is available to shelter cumulative gifts within the threshold currently 5490000. For the 2021 tax year the limit. However some gifts are outside the taxs scope including.

Only gifts with a present interest qualify for the annual gift tax exclusion. In addition to the lifetime gift and estate tax.

:max_bytes(150000):strip_icc()/couple-outdoors-woman-opening-greeting-card-EA7017-003-57853b3a5f9b5831b5ffd1bd.jpg)

What Is An Annual Exclusion Gift

Arsement Redd Morella Llc A Professional Tax And Accounting Firm In Lafayette Louisiana Monthly News

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

The Generation Skipping Transfer Tax A Quick Guide

The Gift Tax Turbotax Tax Tips Videos

Make Gifts That Your Family Will Love But The Irs Won T Tax La Grasso Abdo Silveri Pllc

Gift Tax Annual Exclusion Ppt Download

Gift Tax Exclusion For Tuition Frank Financial Aid

Gifting Time To Accelerate Plans Evercore

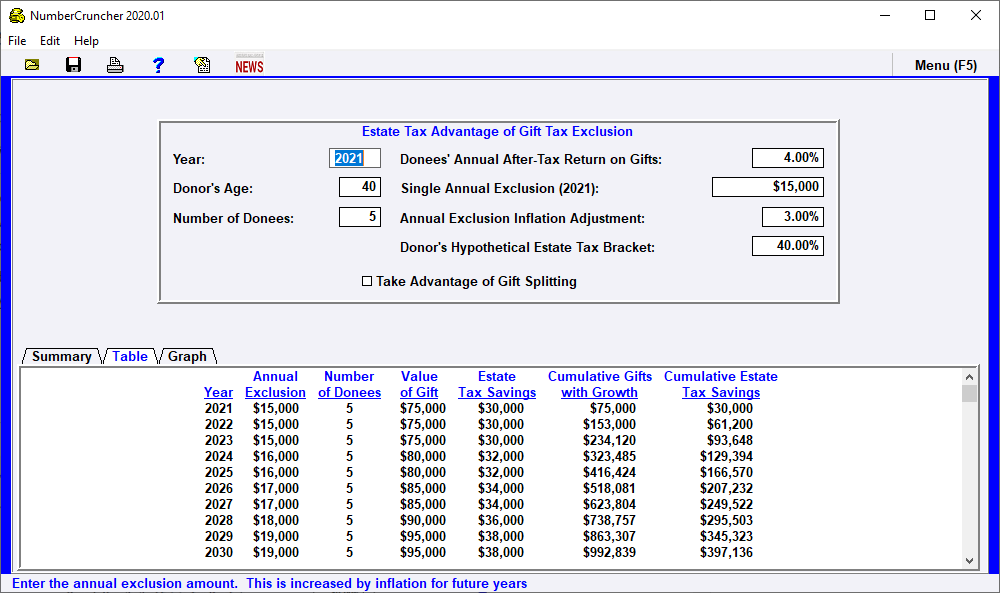

Exclusion Estate Tax Advantage Of Gift Tax Exclusion Leimberg Leclair Lackner Inc

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

By Kenneth J Crotty J D Ll M Ppt Video Online Download

Annual Gift Tax Exclusions First Republic Bank

Gifts Your Family Will Love But The Irs Won T Tax Davis Law Group

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset